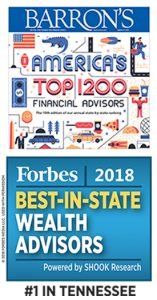

Capwealth Founder Named No. 1 Financial Advisor In Tennessee By Forbes, Barron’s

May 16, 2018

Tim Pagliara is the first and only financial advisor in Tennessee to simultaneously earn top honors from both leading financial publications.

Tim Pagliara, founder, chairman and CEO of independent registered investment advisory firm CapWealth, was named No. 1 Financial Advisor in Tennessee by Barron’s magazine and also topped the list of Forbes’ recently released Best-In-State Wealth Advisors for 2018.

Pagliara’s accolades mark the first time a Tennessee financial advisor has concurrently resided atop both publications’ national rankings. He previously earned the top spot in Barron’s annual state-by-state ranking five times (consecutively from 2012 to 2016).

Barron’s Top 1,200 Advisors rankings are based on data provided by more than 4,000 of the nation’s most productive advisors, and factors include assets under management, revenue generated by the firm’s advisors, regulatory history, quality of practice and philanthropic work. Forbes’ Best-In-State Wealth Advisors list spotlights more than 2,000 top-performing advisors across the country who were nominated by their firms and then researched, interviewed and assigned a ranking within their respective states. Forbes partners with SHOOK Research, who determines the rankings based on an algorithm of qualitative and quantitative criteria, including in-person interviews, industry experience, community involvement, client retention data and revenue trends.

“Recognition as the best in the state by both Barron’s and Forbes underscores the focus of CapWealth’s entire team,” Pagliara said. “CapWealth’s knowledge and experience are crucial in executing our unique, trademarked process which allows us to provide the most sophisticated, straightforward and transparent advice to clients—something they won’t always find elsewhere.”

Pagliara started his firm in 2000 after nearly 20 years in the financial industry with the goal of serving clients better in two distinct ways: the exclusive use of market-traded securities and an emphasis on accountability and transparency. CapWealth practices Sophisticated Simplicity®, the art of thoroughly understanding a complicated global markets landscape and boiling it down to high-quality, straightforward investment ideas. To provide clients with a clear understanding of their returns and costs, the firm relies upon Provable Integrity™, a proprietary tracking and reporting system utilizing state-of-the-art data-aggregation technology and compliance with the rigorous standards of the Global Investment Performance Standards (GIPS).