White House 2020 $2T Stimulus Package: How It Impacts You

March 30, 2020

The White House has agreed to the first Fiscal Stimulus Package in over 10 years, effective Friday, March 26. This bill does not have the same mandate as the rescue plan of 2008. Whereas the rescue plan dealt with shaky financial institutions, this is a relief bill to help ordinary Americans weather the health crisis through a wide variety of initiatives.

How does this impact you, and what are the eligibility requirements?

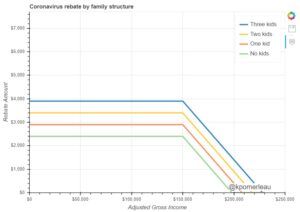

- Based on your most recent tax forms, the amount of payment received depends on your most recent calendar year Adjusted Gross Income and whether you are married or single.

- For Single individuals, you receive a rebate payment of $1,200 if adjusted gross income is below $75,000.

- From $75,000, this payment decreases gradually as an individual’s adjusted gross income approaches $99,000. An individual with an income above that amount does not receive a rebate payment.

- For married couples, the requirement and payment numbers above double.

- Every child under the age of 17 adds an additional $500 to the initial rebate payment amount, not incorporating adjusted gross income.

- The rebate is non-taxable, and the IRS will consider eligibility for 2020 tax returns if not eligible in 2019.

- The bill and federal government also urged lenders to relieve individuals on student loans and mortgages through forbearance on their payments for up to six months.

- The bill increases the unemployment benefit duration from 26 weeks to 39 weeks, with a $600/week payment increase and expands insurance eligibility to individuals impacted by COVID-19.

Single Individual Payment Structure:

How does the bill impact your retirement accounts?

- Required minimum distributions (RMDs), which those over 72 years old must take from traditional IRAs, SEPs and 401(k) accounts, have been waived for 2020. This has no impact to Roth IRAs.

- If you’ve already received a distribution from your own IRA or one inherited from a spouse for 2020, you can roll it back into your IRA within 60 days of receipt.

- The limit for retirement plan loans not treated as distributions has been temporarily raised from the normal $50,000 to $100,000 for six months, while the current rule that loans may not exceed half of a 401(k) participant’s vested account balance has been waived.

- If you had a retirement account loan payment due from the date of the bill to year-end 2020, that payment due date shall be delayed for 12 months.

- You are eligible to take a $300 tax deduction on adjusted gross income, from charitable donations for 2020, in additional to the standard tax deduction ($12,400 for individuals and $24,800 for married couples filing jointly).

If you can provide certification/confirmation to your plan administrator that you: 1) have been diagnosed with COVID-19, 2) have a spouse who has been diagnosed with COVID-19, or 3) have experienced adverse financial consequences from quarantine (business closure, laid off, etc.), then the following actions may be taken on 401(k) and IRA retirement accounts:

- If under 59 ½, Retirement Account owners are eligible to make a distribution of up to $100k without paying the 10% early withdrawal fee.

- The sum withdrawn may be re-contributed to a retirement account within three years, without being subject to the usual annual contribution caps.

- If the account is not repaid, the withdrawal will be taxed as ordinary income tax rates over a three-year period.

- You can make a Roth conversion with this distribution. Before you typically must take out RMDs before making a Roth conversion.

- If you’re 70 1/2 or older this year, you can give up to $100,000 directly from your IRA to charity in what’s known as a charitable IRA rollover, or a charitable qualified distribution. Normally this type of rollover counts towards your RMD.

How will this impact Corporations?

The bill includes but is not limited to:**

- $100B in grant assistance to healthcare providers, to help respond to and prepare for the virus cases, including equipment, telehealth, and insurance reimbursements.

- $350B in loan assistance provided to small businesses assuming economic loss, in an effort for job retention and debt relief on existing loans.

- $500B in loan assistance for corporations in industries that have been hurt by the outbreak. This includes airlines, potentially in exchange for equity stakes taken by the treasury, and relief for companies which are part of the country’s national security.

- $150B in state and local stimulus funding, for expenses related to COVID-19 and costs related to significant unemployment levels.

- Corporation lending will be administered by the US Treasury through Federal Reserve emergency lending facilities, which new activity will be announced to the public over time.

- Firms who accept loans from the program are required to suspend any dividend payments and share repurchase agreements, ban all labor force cuts of 10% or more, and implement compensation caps for executive pay employees.

- Airlines receiving loans must maintain service to existing destinations and routes. Air travel excise and fuel taxes will be suspended for all of 2020. In addition to the loan program, $32 billion is earmarked for payroll assistance for airlines and contractors.

- In addition to lowering rates to 0, and implementing the first Quantitative Easing major asset purchase program since the 2008 Financial Crisis, the Federal Reserve has provided emergency funding access and waived capital adequacy requirements for Banks, so they can provide loan accessibility to households and businesses impacted by COVID-19.

**We will update this section as more details are released by the Treasury.

While the bill does not specifically single out any industries in which our holdings have direct exposure, we continue to monitor our existing portfolio holdings over time, as more details arise from the corporate stabilization efforts made by the federal government.